Element Solutions Inc Announces Two Strategic Semiconductor Transactions

MIAMI, Fla., June 5, 2023 – Element Solutions Inc (NYSE:ESI) ("Element Solutions" or the “Company”), a global and diversified specialty chemicals company, announced two transactions to enhance its capabilities and deepen customer relationships in advanced electronics materials markets. Together, these transactions represent approximately $15 million of annualized adjusted EBITDA with significant growth potential as electronics markets improve and certain new technologies win customer qualifications.

- Element Solutions has agreed to pay $185 million, net of estimated cash tax benefits, to Entegris, Inc. to terminate its long-standing distribution agreement for ViaForm® electrochemical deposition products. These wafer level plating products for the world’s largest semiconductor fabricators are currently developed and manufactured by MacDermid Alpha Electronics Solutions, a business unit of Element Solutions, and have been distributed by Entegris under an evergreen distribution agreement. Following a transition period, Element Solutions will manage all aspects of the ViaForm® product line in-house, which we believe will result in a more efficient supply chain and improved customer outcomes. The payment will be funded by a combination of cash on hand and an incremental $150 million borrowing under the Company’s senior credit facility.

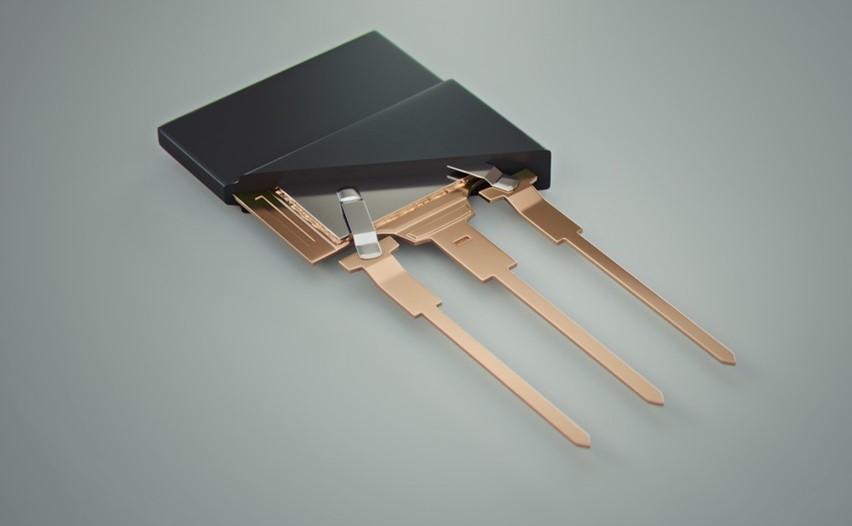

- Element Solutions has acquired Kuprion, Inc., a developer of next-generation nano-copper technology to the semiconductor, circuit board and electronics assembly markets. The company’s ActiveCopperTM technology addresses the effects of thermal expansion and offers superior performance and reliability in a host of growth applications, including electric vehicles, high frequency 5G networks, IC substrate manufacturing, advanced packaging, mission critical aerospace and defense systems, and datacenters. This transaction has been structured with an upfront payment and potential earn-out payments based on milestones associated with product qualification and revenue over several years.

President and Chief Executive Officer Benjamin Gliklich said, “These transactions deepen our relationships and capabilities in compelling, long-term growth markets propelled by the proliferation of high-performance computing supporting artificial intelligence, industrial automation, and other emerging applications. The current weakness in the electronics sector represents an attractive opportunity to invest and position ourselves for the inevitable recovery. Entegris has been a solid long-term partner distributing our ViaForm® technology. Over time, however, we both agreed that unified responsibility of all aspects of the product cycle - from innovation and manufacturing through to sales and support - would be best for our customers and the growth of the product line. These products are integral to semiconductor production at the largest fabricators in the world and strengthen our relationships and value-proposition to this important supply chain. The transaction is revenue growth, margin, and CRI (Cash Return on Investment) accretive and should increase the contribution of our Electronics segment to the Company’s annual adjusted EBITDA to over 70%. We thank Entegris and its legacy companies for their partnership over 20 years and for the strong commercial position they helped build. We look forward to providing an improved offering to our customers.”

Mr. Gliklich continued, “Our acquisition of Kuprion brings another highly-differentiated capability to our portfolio together with the world-class R&D and applications team who developed it. Their technology is designed to solve the increasingly difficult challenges associated with thermal management and adhesion in leading-edge electronics. We believe this represents industry-changing technology with broad applications across our portfolio, from semiconductor packaging to IC substrate metallization and electronics assembly. Combining Kuprion’s solutions and technical capability, already sought after by many of our largest customers, with our breadth of sales, service and applications expertise will create tremendous growth opportunities.”

Mr. Gliklich concluded, “The transactions we are announcing today together are immediately accretive to adjusted earnings per share (EPS) and result in a sizeable cash tax benefit. We expect a net debt to adjusted EBITDA ratio of 3.6x at the end of the second quarter of 2023, which we expect to return below our 3.5x long-term target by the third quarter and decline even further in the fourth quarter of this year. We believe this is appropriate given these unique capital allocation opportunities, which enhance growth opportunities and business quality and which were available at reasonable valuations in this market window.”

About Element Solutions Inc

Element Solutions Inc is a leading specialty chemicals company whose businesses supply a broad range of solutions that enhance the performance of products people use every day. Developed in multi-step technological processes, these innovative solutions enable customers' manufacturing processes in several key industries, including consumer electronics, power electronics, semiconductor fabrication, communications and data storage infrastructure, automotive systems, industrial surface finishing, consumer packaging and offshore energy. More information about the Company is available at www.elementsolutionsinc.com.

Non-GAAP Measures

This press release includes forward-looking financial measures which are not calculated in accordance with GAAP, including annualized adjusted EBITDA, and net debt to adjusted EBITDA ratio. Definitions of these non-GAAP financial measures can be found in Element Solutions’ earnings releases posted on its website under Investors and News/Events.

The Company does not provide a quantitative reconciliation of these forward-looking non-GAAP measures to GAAP due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation, including adjustments that could be made for restructurings, refinancings, divestitures, impairments, integration and acquisition-related expenses, share-based compensation amounts, non-recurring, unusual or unanticipated charges, expenses or gains, adjustments to inventory and other charges reflected in the reconciliation of historic numbers, the amount of which, based on historical experience, could be significant.

Forward Looking Statements

This press release contains forward-looking statements including, but not limited to, statements and expectations relating to the operational and financial benefits of the Entegris and Kuprion transactions. These statements and expectations are based on management's estimates and assumptions with respect to financial performance and future events, and are believed to be reasonable, though are inherently difficult to predict. Actual results could differ materially from those projected as a result of certain factors including, without limitation, market and other general economic conditions, Element Solutions’ perception of future availability of financing as well as other factors included in its periodic and other reports filed with the Securities and Exchange Commission. Element Solutions undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

CONTACT:

Investor Relations Contact:

Varun Gokarn

Senior Director, Strategy and Finance

Element Solutions Inc

1-203-952-0369

IR@elementsolutionsinc.com

Media Contact:

Liz Cohen

Managing Director

Kekst CNC

1-212-521-4845